A new and alarming text message scam has recently emerged, aimed at tricking innocent people into handing over their sensitive personal and financial information. The deceptive text message claims that the recipient has an outstanding toll road fee that must be paid immediately to avoid additional charges. However, the link provided leads to a fake website designed to steal personal data for criminal purposes.

This article will provide an in-depth overview of how this text scam works, who is behind it, and most importantly, how you can protect yourself from falling victim.

An Overview of the Scam That’s Targeting Innocent Drivers

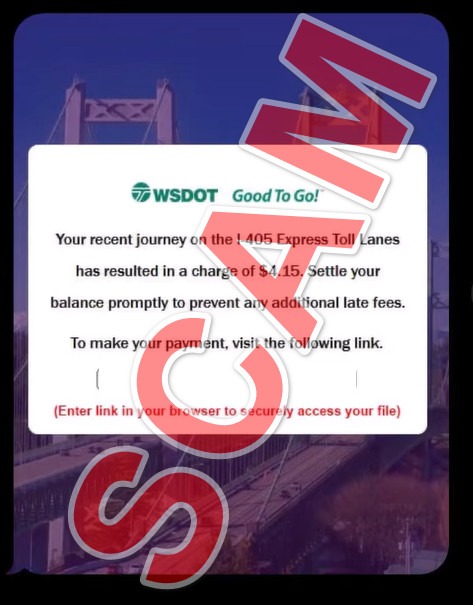

The text message scam starts with an unsolicited text sent to the victim’s mobile phone, appearing to come from a state’s Department of Transportation (DOT). For example, the message claims to be from the Washington State DOT, referencing the I-405 Express Toll Lanes.

The message states that a recent trip on the toll road has resulted in unpaid tolls, usually a small amount like $4.14. It goes on to say that the balance must be paid promptly, via the link provided, to avoid additional fees. The link leads to a fake website, wagtg.com, which has been set up solely to harvest users’ personal and financial data.

This scam is particularly devious for several reasons:

- It appears very official and legitimate, using real DOT names and logos, and referencing actual toll roads. This tricks users into trusting it.

- The outstanding balance is small, just a few dollars, so users are more inclined to just quickly pay it than risk extra fees.

- It preys on people’s fear of additional charges or damage to their credit score.

- The SMS-based delivery makes it easy for scammers to blast out huge volumes of messages en masse and reach thousands of potential victims quickly.

Unfortunately, many innocent users are falling for this scam and unwittingly handing over extremely sensitive information to cybercriminals. The consequences can be severe, from identity theft to stolen funds. Awareness is key to avoid becoming a victim.

How The “Settle Your Balance” Toll Roads Text Scam Actually Works

The “settle your balance” text scam is meticulously designed to dupe recipients into giving up their personal details. Here is a step-by-step overview of exactly how it works:

Step 1: The Victim Receives an Unsolicited Text Message

The scam begins with the victim receiving an SMS on their mobile phone, appearing to come from the Department of Transportation in their state. For example:

“WSDOT GoodTo GO! Your recent journey on the I-405 Express Toll Lanes has resulted in a charge of $4.14. Settle your balance promptly to avoid any additional fees.”

The message looks official, referencing real state DOT program names like GoodToGo. The small outstanding balance of $4.14 seems believable.

Step 2: The Message Instructs Recipient to Pay Balance Through Link

The text includes instructions to pay the $4.14 balance promptly, before additional fees are charged. It directs the victim to click on a link to settle the payment.

“To make your payment, visit the following link: wagtg.com”

For victims already stressed about extra fees, this creates a sense of urgency to take action quickly by visiting the link.

Step 3: The Link Goes to a Fake Website Collecting Personal Data

Clicking the link leads to a website, wagtg.com, dressed up to mimic a legitimate state DOT site. It has a payment form asking for your personal and payment details to settle the outstanding toll balance.

In reality, this site has been set up by scammers to harvest entered personal data. No information submitted goes to paying fake tolls, but rather straight into the hands of criminals.

Step 4: Scammers Steal and Sell User Data

Once victims enter details like their name, address, phone number, and credit card info into the fake payment forms, the scammers have what they want.

The cyber thieves then take this trove of personal data and sell it on the dark web to other criminals. It can also be used directly for financial fraud like opening credits cards in the victim’s name.

In the end, all that is stolen is the user data – there never were any actual unpaid tolls to settle. But the resulting identity theft can be a massive nightmare for the victim.

What To Do If You’re the Victim of a “Settle Your Balance” Text Toll Scam

If you received one of these fraudulent text messages and unfortunately clicked the link and/or entered your information, here are important steps to take right away:

- Contact your bank/credit card company: If you entered any financial account data, call your bank or credit card company if it was compromised. Cancel cards or accounts as needed.

- Place fraud alert on your credit: Contact one of the three credit bureaus (Experian, Equifax, TransUnion) to place an initial 90-day fraud alert on your credit file. This makes it harder for criminals to open new accounts in your name.

- Monitor your accounts and credit reports: Check your financial accounts and credit reports frequently for any signs of misuse of your information. Report unauthorized activity immediately.

- Change passwords: If you reuse passwords between accounts, change them now on any other accounts that use the same password.

- Consider credit/identity theft monitoring: Sign up for ongoing identity theft monitoring services to alert you of suspicious new account openings or credit inquiries.

- Report the scam: File an FTC scam report and notify your state attorney general. Provide details to help authorities stop these criminal operations.

- Spread awareness: The more these text toll scams spread, the more victims they claim. Make family and friends aware of this scam to prevent them from also falling victim. Knowledge truly is power when it comes to scams.

The aftermath of identity or financial theft can be difficult and time consuming to undo. But taking quick action minimizes the potential damage. Don’t panic, just follow these steps to protect yourself after the fact.

Who is Behind This Text Toll Scam and Why

These “settle your balance” text scams are being orchestrated by sophisticated cybercriminal networks dedicated to large-scale identity theft and financial fraud. While the exact individuals behind any given scam are hard to pinpoint, we can identify the characteristics and motivations of such groups:

- Organized crime rings – Many identity theft scams originate from organized cybercrime gangs, often based overseas beyond the reach of US law enforcement. They operate large-scale scam operations.

- Financial gain – The sole motive is to steal private personal data like names, birth dates, social security numbers, and financial account information. This data has huge value on the black market.

- Targeting victims en masse – By blast-texting scams impersonating legitimate businesses to thousands of phones at once, they can reel in a large number of unaware victims quickly and easily.

- Make stolen data hard to trace – By creating “cutout” fake websites to harvest the data, they add separation from themselves and make the stolen data harder to trace back.

- Sophisticated online skills – These criminals are tech-savvy experts in creating convincing phishing sites, spoofing caller ID info, and identity theft techniques.

In many cases, victims have little recourse in bringing these offshore cybercrime groups to justice. The best protection is awareness of their tactics to avoid falling into scams in the first place.

How to Protect Yourself from Text Toll and Other SMS Scams

While text toll scams are surging, there are ways to avoid being the next victim. Here are some best practices to keep yourself and your data safe:

- Never click links in unexpected texts– If you get an unsolicited SMS with a link, do NOT tap it, no matter how convincing. Manually type in known website addresses.

- Verify senders– Don’t trust display Caller ID info. Even real contacts can have numbers spoofed. Verify a text directly with the supposed sender before clicking links or calling numbers.

- Check for telltale signs– Official messages don’t have errors or use urgent high-pressure tactics. Always double check for poor spelling/grammar, threats of fees, and other red flags.

- Don’t overshare personal info– Avoid handing out info like your SSN or bank details unless absolutely necessary and you confirmed the requester’s legitimacy.

- Use antivirus/antimalware software– This helps detect phishing scams and block known fraudulent sites and sources of texts. Keep it updated.

- Set text spam filters– Block texts from unknown sources in your phone’s message settings. But scammers still sneak through, so the ultimate protection is your awareness.

No one wants to think they could fall for a scam. But these cybercriminals are experts at impersonation, pressure tactics, and disguising their intent.

Frequently Asked Questions About the “Settle Your Balance” Toll Roads Text Scam

1. What exactly is the “settle your balance” toll roads text scam?

This is a scam where victims receive a text message claiming to be from their state Department of Transportation (DOT) regarding unpaid toll balances. The message says that to avoid fees, the victim must pay a small balance (usually $3-5) through a provided link. However, the link goes to a fake website designed to steal entered personal data. There are no actual unpaid tolls, just scammers seeking your private info.

2. What details do the fake text messages contain?

The texts reference real state DOT names, specific toll roads, and small unpaid “balances” of a few dollars. They claim you must pay promptly through the link or face additional fees. All of this is fabricated to trick users into trusting the texts are legit.

3. What happens when victims click the link?

The link goes to a sophisticated fake website impersonating a state DOT site. Victims are prompted to enter personal info like name, address, phone number, and even financial account details to “pay” the fee. The data is stolen by scammers, not actually used for any toll payments.

4. What do scammers do with the stolen personal data?

The scammers sell the information on the dark web to cybercriminals who use it for identity theft – opening fraudulent credit cards and accounts in the victim’s name. The personal details can sell for over $1,000 on black market sites.

5. Who is behind these text toll scams?

They are executed by organized overseas cybercrime rings who mass-blast the texts to thousands of phones at once. By using “cutout” fake sites, they remain anonymous. Their only goal is stealing data for profit, not collecting toll payments.

6. How can I avoid becoming the victim of a text toll scam?

Never click unsolicited text links, no matter how official they appear. Manually navigate to any website. Verify senders directly if unsure. Watch for poor grammar, threats, and other red flags. Don’t hand out personal info freely. Use spam blocking and antivirus software.

7. What should I do if I clicked the link and entered my information?

Immediately contact your bank and credit card companies if compromised. Place fraud alerts and monitor your credit reports closely for signs of identity theft. Change account passwords and consider credit monitoring services. Report the scam to authorities to help prevent further victimization.

8. Why are these text scams so dangerous?

They prey on two things – fear of late fees from seemingly official sources, and our inclination to quickly pay small outstanding bills. Even just getting your name and contact info puts you at huge risk of financial fraud. The consequences can be severe.

9. How can I help prevent others from falling victim?

Education is key. Warn your friends and family about current text scams, and how to detect them. Share scam alert posts online to spread awareness. The more we talk about fraud threats, the safer everyone in our community will be.

10. Will these text toll scams continue?

Unfortunately, yes. As long as these scams successfully dupe victims, the cyber thieves will continue running new variations. Our best protection is staying vigilant about the latest scam tactics and threats. Being informed is the best way to outsmart the scammers.

The Bottom Line

In summary, this emerging text scam targeting toll balances is a dangerous fraud sweeping the nation. By appearing to come from official DOT sources, threatening extra fees, and providing convincing fake payment links, it has already duped countless innocent drivers.

The cybercriminals running these text scams are organized, tech-savvy, and ruthless in stealing personal data for sale and financial fraud purposes. Even just handing over your name, phone and address poses huge identity theft risks that are difficult to undo.

If you find yourself a victim of a text toll scam or any other SMS fraud, take immediate steps to protect your accounts, monitor your credit, change passwords, place fraud alerts, and report the crime.

While we all have to be vigilant against the endless creativity of scammers, following smart security best practices can minimize your risk of being a victim. Never click suspicious text links, verify senders, watch for warning signs, and keep software up to date.

With identity theft and online fraud on the rise, awareness truly is the best weapon we have. Keep talking about scam threats with those you care about. You could prevent the financial and emotional pain of identity theft for someone you love.