That innocent-looking text message about unpaid SunPass tolls – don’t be fooled. It’s actually a sneaky new phishing scam trying to trick Florida drivers out of their personal information and credit card details.

These scammers are getting clever with frighteningly authentic-looking messages claiming you owe urgently owe small toll fees. Don’t let them rush you into a costly mistake.

Take a closer look, and the scam becomes obvious. That link doesn’t lead to SunPass at all. This is just a ploy to hijack your identity and drain your bank account.

Don’t become their next victim. Keep reading to learn how to spot these SunPass toll text scams and outsmart the schemers. We’ll reveal everything about this fraudulent operation targeting Floridians and how to protect yourself now.

Overview of the SunPass Florida Turnpike Toll Text Message Scam

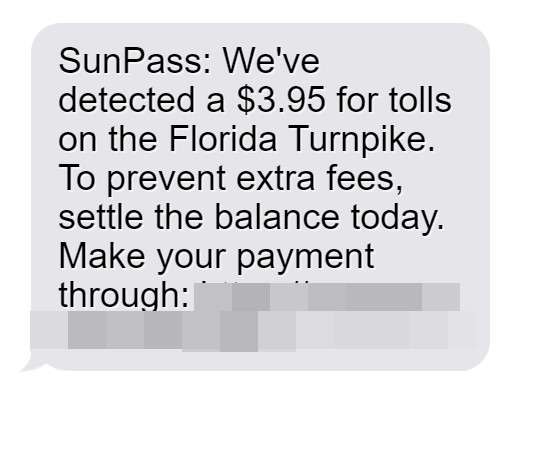

This toll scam starts when people receive a text message that appears to be from SunPass. The message claims SunPass has detected unpaid toll fees on the victim’s account from driving on the Florida Turnpike.

The text states that the driver now owes $3.95 in unpaid tolls. It threatens that extra fees will be charged if the $3.95 toll balance is not paid immediately. A link is conveniently provided to quickly settle the payment and avoid the extra fees.

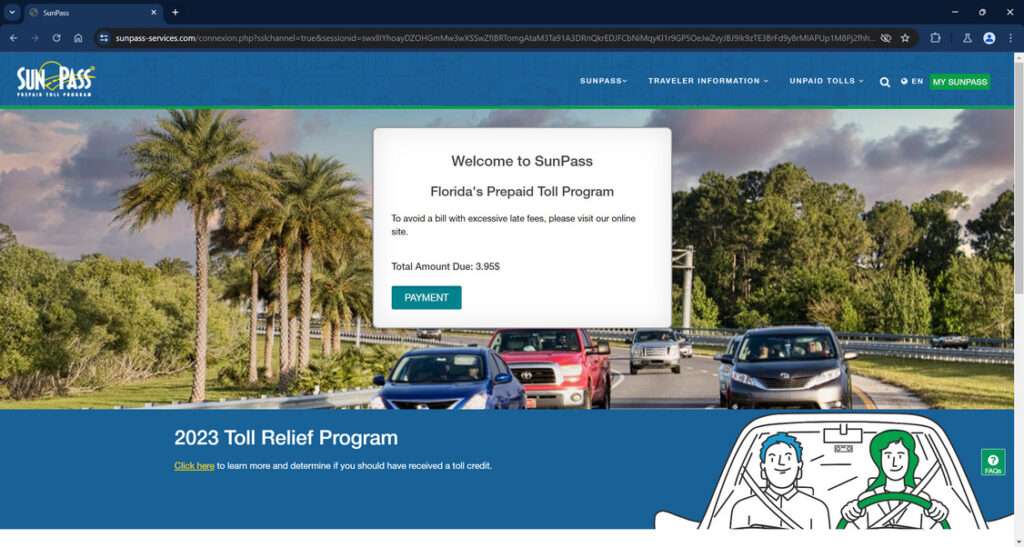

However, the link in the text does not actually go to the official SunPass website. Instead, it takes victims to a sophisticated fake website dressed up to impersonate SunPass and trick users into believing it is legitimate.

The fraudulent site has the SunPass logo and branding throughout. The scam website claims to be the “Florida’s Prepaid Toll Program” in the header just like the real SunPass site. This makes it look credible at first glance.

The fake SunPass site first reiterates the urgent need to pay $3.95 in unpaid tolls, saying “To avoid a bill with excessive late fees, please visit our online site.” It lists the “Total Amount Due: $3.95” just like the text stated.

These details match the original scam text, which tricks victims into thinking this site can process their SunPass payment. The scam page also promotes a fake “2023 Toll Relief Program” and tells users to “Click here” for more information. This adds legitimacy by mimicking SunPass’ occasional incentive programs.

After victims land on the fraudulent site, the next step is asking them to enter personal and financial information. The scam page claims this is required to process the $3.95 toll payment.

Forms on the fake SunPass site ask users to input details including their:

- Full name

- Home address

- Phone number

- Email address

- Credit card number

- Expiration date

- CVV code

The scam site claims this data is needed to look up your SunPass account and process the urgent $3.95 toll transaction. But in reality, the scammers steal all the information entered on the fake forms.

With a user’s name, address, date of birth, and driver’s license number, the scammers can commit identity theft. They can use these details to open fraudulent accounts, take out loans, file fake tax returns, and more.

Meanwhile, a victim’s credit card number, expiration date, and CVV code allows the scammers to make unauthorized purchases or resell the card details on the dark web.

The fake SunPass site may even have an online map where victims can supposedly pinpoint exactly where the mystery $3.95 toll charge occurred. This adds an extra layer of deception to make the unpaid toll seem real.

But of course there was no actual toll charge – the scammers completely fabricated the $3.95 fee. After victims enter their sensitive personal and financial details, the scammers have exactly what they wanted to commit fraud.

Some variations of the scam even prompt users to set up a fake SunPass account on the fraudulent site after entering their info. This account creation process further tricks victims into believing the site is legitimate.

In reality, the scam site simply harvests and transmits all data directly to the scammers. There is no actual SunPass account set up, nor any $3.95 toll transaction processed.

But victims may not realize they have been conned until unauthorized charges begin to appear or they are contacted by debt collectors about loans fraudulently taken out in their name. Meanwhile, the scammers profit off the stolen information and disappear without a trace.

The SunPass text toll scam shows how far scammers will go to impersonate trusted sources. With fake websites and payment claims, they take advantage of victims trying to do the right thing by paying a bill. This scam is specifically designed to steal as much personal data as possible under the guise of collecting a mysterious unpaid $3.95 toll charge.

How the SunPass Florida Turnpike Toll Text Scam Works

Here is a step-by-step breakdown of how this SunPass text scam operates:

Step 1: Victims Receive the Scam Text

The first step is simple. Unsuspecting people receive the fake SunPass text message on their mobile phone. The message looks like this:

“SunPass: We’ve detected a $3.95 for tolls on the Florida Turnpike. To prevent extra fees, settle the balance today. Make your payment through: https://sunpass-services.com”

The text appears to come from a legitimate source – SunPass. And the message creates urgency and fear with the threat of extra fees. This tricks victims into acting fast without thinking.

Step 2: Victims Click the Link

If the text scam is successful, victims will click the link provided without carefully examining it first. The link uses the domain “sunpass-services.com” which seems believable.

However, the real SunPass website is sunpass.com. The scam link goes to a fake site impersonating the real SunPass. Victims may not notice this, especially if they click on mobile and do not see the full URL.

Step 3: Victims Land on the Fraudulent Website

After clicking the link, victims land on a website dressed up to look like an official SunPass site. It has SunPass branding and claims to be a toll management service. This helps trick users into believing it is legitimate.

The scam site first shows information about unpaid tolls, penalties, and the urgent need to pay the $3.95 balance. This reiterates the fake claim in the text to reinforce victims’ fears.

Step 4: Scammers Request Personal and Financial Information

Next, the fraudulent site presents forms asking users to enter personal and payment details, including:

- Full name

- Home address

- Phone number

- Date of birth

- Credit card number

- Expiration date

- CVV security code

The scam site claims this information is needed to process your $3.95 toll payment. But in reality, the scammers steal data entered on the site.

Step 5: Scammers Take the Stolen Data

Once victims input their information, the scammers have what they want. They take the stolen personal and financial data to commit identity theft and credit card fraud.

Because the site is completely fake, there is no actual $3.95 toll transaction processed. But victims may not realize this before it is too late. The scammers can quickly rack up fraudulent charges on stolen cards.

Meanwhile, the victims’ personal information like name, address, and DOB can be used for many other types of fraud. This includes opening fake accounts, taking out loans, filing false tax returns, and more.

Step 6: Scammers Disappear Without a Trace

After collecting data from enough victims, the scammers take down the fraudulent website and disappear. They are experts at covering their tracks online, so they can rarely be caught.

Even if victims realize it was a scam, the damage is already done. The scammers have their stolen personal and financial information. They used temporary prepaid cards and false identities to register scam site domains.

This makes it very difficult for authorities to track the fraudsters down. Meanwhile, the victims are left to deal with the aftermath like fraudulent charges and identity theft.

What to Do If You Receive the SunPass Toll Text Scam

If you get the suspicious SunPass text message claiming you owe $3.95 in tolls, do NOT click the link or provide any personal information. Here are the steps to take:

1. Delete the text immediately.

Do not reply or click anything in the scam text. Delete it to cut off contact with the scammers entirely.

2. Call the real SunPass customer service line.

Contact SunPass at 1-888-TOLL-FLA to report the scam text. Make sure there are no actual unpaid tolls on your real account.

3. Check your SunPass account activity.

Log into your official SunPass account on sunpass.com. Carefully review activity for any unauthorized charges. Contact SunPass if you see anything suspicious.

4. Watch out for additional scam attempts.

Be alert for follow-up scam texts or emails related to SunPass. Delete these attempts and do not click links or attachments.

5. Place alerts on your credit reports.

To guard against potential identity theft, contact Equifax, Experian, and TransUnion to put a fraud alert on your name and SSN.

6. Closely monitor bank and credit accounts.

Watch for any fraudulent charges from scammers who may already have obtained your information elsewhere. Report unauthorized transactions right away.

7. Be wary of links and texts from unknown sources.

Going forward, be cautious about clicking links in texts, emails, and online ads without first verifying the source. When in doubt, directly confirm with the company a message claims to be from.

Following these steps can help protect you from being tricked by the SunPass text toll scam. Outsmart the scammers by recognizing their deceptive tactics and proactively monitoring your accounts. Share this information with family and friends to prevent them from becoming victims too.

Frequently Asked Questions About the SunPass Toll Text Scam

1. What is the SunPass toll text scam?

The SunPass toll text scam is a phishing scam where victims receive a text message claiming to be from SunPass. The message says SunPass detected unpaid toll charges on your account for driving on the Florida Turnpike. It claims you owe $3.95 in tolls and face extra fees if not paid immediately. A link is provided to pay the $3.95, but it goes to a fake website instead of the real SunPass. The fraudulent site then collects your personal and financial information under the guise of processing your payment. In reality, scammers steal the data you enter on the site to commit identity theft and credit card fraud.

2. How do I identify the SunPass toll scam text?

The scam SunPass texts have these red flags:

- They demand payment of a random small toll fee like $3.95 without any explanation of where/when it occurred.

- They threaten immediate extra fees or penalties if the mysterious toll is not paid right away.

- The link goes to “sunpass-services.com” or another sketchy domain – not the official “sunpass.com”.

- Asks for sensitive personal and payment data to process a tiny $3.95 transaction.

3. I got the text. What should I do now?

If you receive the suspicious text, do NOT click the link or provide any personal information. Steps to take:

- Delete the scam text immediately.

- Call SunPass at 1-888-TOLL-FLA to report the scam text.

- Check your real SunPass account for any unauthorized charges.

- Watch for related phishing attempts and delete them.

- Put a fraud alert on your credit reports as a precaution.

- Monitor bank and credit accounts closely for fraudulent charges.

4. How do the scammers profit from the SunPass text scam?

The scammers profit by stealing people’s personal information and credit card details entered on the fake SunPass website. They use this data to commit identity theft and financial fraud. Scammers can quickly rack up unauthorized charges on stolen credit cards. They can also open fake accounts, take out loans, file false tax returns and more with stolen info like your name, address and birthdate.

5. How can I avoid becoming a victim of the SunPass text scam?

To avoid being tricked:

- Never click links in suspicious texts from unknown sources. Verify a message is real by contacting the company directly.

- Watch for urgent payment demands over text or email. Real companies generally do not request payments this way.

- Carefully check the full URL of any link before clicking. Beware of lookalike scam domains.

- Do not provide personal or financial data in response to suspicious payment requests.

- Monitor your SunPass account and credit reports regularly for fraud.

- Use security software to block potential phishing texts and emails.

6. What should I do if I already entered my information on the scam site?

If you already input your data into the fake SunPass site before realizing it was a scam, take these steps immediately:

- Contact your credit card company to report fraudulent charges or cancel your card.

- Place a fraud alert on your credit reports to help prevent identity theft.

- Reset all account passwords that used the same credentials entered on the scam site.

- Sign up for credit monitoring to detect any new accounts opened in your name.

- File an identity theft report with the FTC at IdentityTheft.gov.

Taking quick action can help limit the damage from any personal info already stolen by scammers.

Stay vigilant about toll road text scams targeting SunPass customers and drivers across Florida. Spot and report the red flags of phishing texts or emails requesting immediate payment. With caution, you can protect yourself and avoid supporting these criminal operations.

The Bottom Line on the SunPass Toll Text Scam

This scam is specifically designed to take advantage of SunPass customers with Florida toll accounts. The fake text message is intended to hurry victims into paying a made-up $3.95 toll charge without thinking it through. Anyone who provides their personal or credit card information on the fraudulent website risks identity theft and financial fraud.

There are some clear red flags that identify this as a scam:

- Text demands immediate payment of a random small toll fee out of context. Legit tolls are invoiced by mail, not text.

- Text threatens you will incur penalties if the mysterious toll is not paid instantly. SunPass does not actually issue penalties this way.

- Link goes to a sketchy lookalike website, not the official SunPass site.

- Fake site asks for sensitive identity and payment info to process a tiny $3.95 transaction.

Be suspicious of any urgent payment demands over text. Call the company directly if you receive a strange billing notice by text or email. Avoid clicking links from sources you cannot verify. With caution and awareness, Floridians can steer clear of toll road scams.