Imagine checking your phone and seeing an urgent Sunpass text warning you that immediate payment is required for a “toll trip”. If you act fast, you may be able to avoid additional fees. But what if that text was actually from scammers trying to steal your money and identity?

That’s the scary reality behind a new smishing scam targeting drivers. These fraudsters impersonate Sunpass and trick you into providing personal and financial information under the guise of paying fake tolls. With a well-crafted text and convincing website, you could end up compromised before you know it.

Don’t let this scam derail your finances and credit. Read on to learn what to watch for, what to do if you get one of these sneaky texts, and most importantly, how to protect yourself from ever becoming a victim of this clever identity theft ring. Outsmarting them begins with insight into their tactics.

Overview of the Sunpass Unpaid Toll Trip Text Message Scam

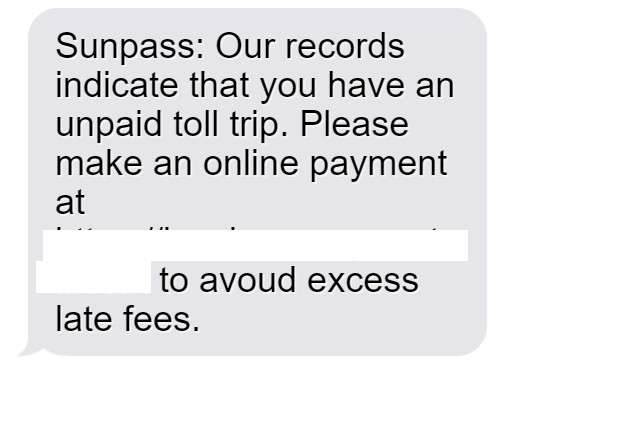

The Sunpass scam starts with an unexpected text message that reads something like:

“Sunpass: Our records indicate that you have an unpaid toll trip. Please make an online payment at [malicious link] to avoid excess late fees.”

The message is made to look like it comes directly from Sunpass. The link often contains the Sunpass name and claims you need to pay outstanding tolls immediately.

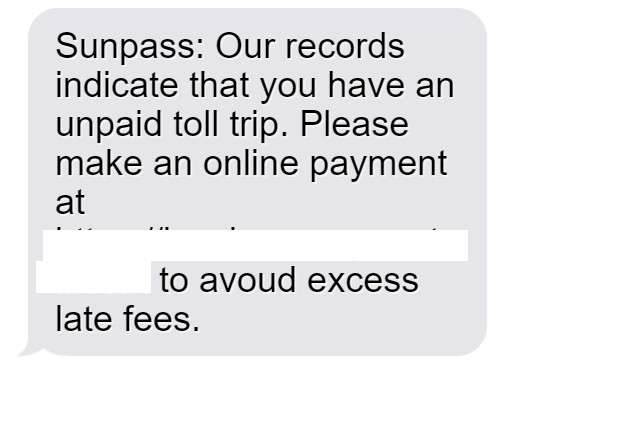

If you click the link, it will take you to a fake website designed to mimic a Sunpass toll payment portal. You will be prompted to enter personal information like your name, phone number, license plate, and even credit card information to pay the “unpaid tolls.”

In reality, the text is not from Sunpass at all. Scammers are sending mass text messages to random phone numbers to catch unaware victims. Providing any information will expose you to identity theft, and entering credit card details could lead to fraudulent charges.

This scam is often referred to as a smishing attack. Smishing combines SMS text messaging with phishing techniques to trick users into providing sensitive information. The messages are unsolicited and come from unknown numbers. They are crafted to create a sense of urgency so victims act before thinking it through clearly.

How the Sunpass Unpaid Toll Trip Text Scam Works

Smishing scams like the Sunpass toll text rely on catching people off guard and exploiting fear. By making victims believe they owe money and could face additional fees, scammers increase the chances people will follow the link without proper scrutiny. Here is how the scam typically works:

1. Smishing Text Messages Are Sent En Masse

The scammers start by sending huge batches of text messages to random cell phone numbers. The messages use common phishing techniques to appear trustworthy, like mentioning Sunpass by name and claiming the victim has unpaid tolls. Regional area codes are often used to increase perceived legitimacy.

2. The Texts Urge Immediate Action

By claiming outstanding tolls exist and fees are accruing by the day, the texts create urgency. This pressures victims to click the link and provide information without taking time to think it through. Language like “pay immediately” and “avoid additional late fees” scare users into reacting hastily.

3. The Link Goes to a Fake Sunpass Website

Clicking the link brings victims to a website designed to mimic the real Sunpass payment portal. From the domain name to page design, it will look authentic at first glance. Forms will ask for personal and payment information to process the “unpaid toll fees.”

4. Victims Enter Personal and Financial Information

If the fake website looks convincing enough, victims will enter their info including name, phone number, license plate number, and even credit card number. Some sites request scans of personal documents too.

5. Scammers Steal Identity and Money

With the provided info, scammers can steal the victims’ identity or make fraudulent purchases and drain bank accounts. The credit card can be charged for fake toll payments. Personal docs can be used to open accounts in the victim’s name.

6. Scammers Disappear Once They Have Your Information

After capturing enough personal and financial details, the scammers take down the fake Sunpass website. With no trace left behind, victims are unaware their data is now in the hands of criminals. The damage has already been done.

This quick hit style scam means that by the time most people realize something is wrong, the scammers have already disappeared with their information. This streamlined process allows them to steal huge amounts of data quickly through smishing text mass blasts.

What to Do If You Receive the Sunpass Unpaid Toll Trip Text

If you receive a suspicious text message claiming you owe Sunpass tolls, do not click the link or provide any information requested. Here are the steps to take:

1. Delete the Text Immediately

As soon as you identify the message as a scam, delete it. Do not interact with the text at all. Clicking links verifies that your phone number is valid. Instead, remove the text completely by deleting the message thread.

2. Call Your Mobile Carrier

Contact your phone carrier and report the scam text. They can block the sending number to prevent future texts. Ask them to place a warning on your account regarding scams impersonating Sunpass.

3. Contact Sunpass

Reach out to Sunpass directly through their official website or customer service line. Report the scam text so they can track these attempts and warn other customers. Check with them to confirm if any real unpaid tolls exist.

4. Monitor Your Accounts

Keep an eye out for any suspicious charges to your credit cards and bank accounts. If you provided information, scammers may make fraudulent purchases or steal money. Report unauthorized activity immediately.

5. Change Passwords

If you entered any account user names or passwords into the fake site, change them right away. Assume the scammers have access to any details you submitted. Update passwords and enable two-factor authentication if possible.

6. Sign Up for Tolling Alerts

Consider signing up through Sunpass for toll alerts by text or email. These legitimate Sunpass messages can warn if you have any actual unpaid tolls in the future. Having alerts enabled can help identify scam texts faster.

7. File Complaints with the FTC and FCC

Report the smishing scam attempt to the Federal Trade Commission and Federal Communications Commission. These complaints help government agencies track and prosecute text scams. The more claims they receive, the more seriously they can crack down.

Deletion is the most important first step to avoid verification and follow up texts. Beyond that, reporting the scam helps warn others and prevents your information from being misused if you mistakenly provided details to the fake website.

What to Do If You Already Fell Victim to the Scam

If you entered your personal or financial information into the Sunpass scam website before realizing it was fraudulent, take the following steps immediately:

1. Contact Your Bank

If you entered any debit/credit card information, contact your bank and notify them of the fraudulent charges. Request that the charges be reversed and the card canceled and reissued to prevent additional fraudulent charges. Enable text/email alerts on accounts to monitor transactions.

2. Place Fraud Alert

Contact one of the three credit bureaus (Experian, Equifax, TransUnion) to place an initial 90 day fraud alert on your credit file. This requires creditors to verify identity before opening new accounts, protecting you from identity theft.

3. Report Identity Theft

File an identity theft report with the FTC at IdentityTheft.gov. Provide any evidence you have, like the scam text or confirmation numbers from fraudulent purchases. This creates an official record that you can use with creditors.

4. Change Account Passwords

If you entered any existing account user name or password combinations into the fake site, change them immediately. Enable two-factor authentication whenever possible for an added layer of security on accounts.

5. Monitor Credit Reports

Order free copies of your credit reports from AnnualCreditReport.com and review them for any unauthorized accounts or inquiries. Dispute any fraudulent activity you find by contacting the credit bureaus. Sign up for credit monitoring.

6. Watch for Other Scams

Once scammers have your information, they may try additional smishing scams or sell your details to other fraudsters. Be hyper vigilant about phishing attempts via text, email, or phone calls asking for personal information.

7. Adjust Text Message Settings

On iPhones, disable text message previews to avoid skimming scam texts. On Androids, download scam call and text blocker apps. Across devices, learn to recognize telltale smishing tactics like urgency and impersonation.

The faster you act to report fraudulent activity and lock down accounts, the less opportunity scammers have to misuse your information further. Rely on official fraud resolution processes to recover lost money and reverse damages.

Protecting Yourself from Future Text Message Scams

Once exposed to a smishing scam, it’s crucial to take preventative measures to avoid falling victim again in the future:

1. Never Click Links in Unsolicited Texts

The number one rule is to never click on links or call numbers in suspicious texts from unknown senders. Smishing scams rely entirely on getting users to click and enter details into bait websites. Avoid interaction completely.

2. Register Your Number on the Do Not Call List

Add your cell phone number to the National Do Not Call Registry. While smishing scammers won’t honor this list, it shows telemarketers that you don’t want unsolicited outreach. This cuts down on unwanted calls and texts.

3. Be Wary of Urgency Tactics

Messages that claim quick action is required should be considered suspicious. Scammers use time pressure tactics to prey on fear and get you to click without thinking. Stop and reconsider any texts pushing immediate payment, account suspension etc.

4. Don’t Trust Sender IDs

Smishing texts often spoof legitimate business names and numbers in the sender ID field. Never assume a text is authentic based solely on the sender name. Double check the validity of urgent payment requests before clicking links or calling numbers.

5. Confirm Through Official Channels

If a text claims you have unpaid bills, suspended accounts, or other issues, confirm directly through the company’s website or customer service line before taking action. Avoid calling numbers or using sites provided in suspicious texts.

6. Secure Your Cell Phone Account

Set up unique account pins and passcodes with your cell provider. Enable two-factor authentication using an app or your email. Add verbal passwords for in-store interactions. This prevents scammers from SIM swapping your number.

7. Use Caution on Public WiFi

Free public networks can be used to send smishing blasts, so avoid clicking links when connected. Use a VPN if possible for added security. Limit sharing or accessing sensitive info over public connections in general.

8. Download Scam Blockers

On Androids, apps like Mr. Number, Robokiller, and Hiya can identify and block likely scam texts in real time. On iPhones, enable filtering through settings or use an app like Nomorobo.

9. Warn Friends and Family

Share information about current smishing scams with your contacts. Warn older adults in your life who may be less tech savvy. Report texts to carriers together and ask to have sending numbers blocked.

Staying vigilant against smishing and other text scams takes some added effort, but could prevent you from falling victim and having your identity stolen. A few simple precautions could protect your finances and personal data.

Frequently Asked Questions About the Sunpass Unpaid Toll Trip Text Scam

1. What is the Sunpass unpaid toll trip text scam?

The Sunpass unpaid toll trip text scam involves receiving a text message claiming you have outstanding toll fees that must be paid immediately. The text provides a link to a fake Sunpass website where you are prompted to enter personal and payment information to process the fee. In reality, it is sent by scammers aiming to steal your data.

2. How do I recognize the Sunpass scam text message?

The scam texts often say something like “Sunpass: Our records indicate you have unpaid tolls. Please pay immediately at [linked website] to avoid additional late fees.” Anything insisting on quick payment for Sunpass tolls via a web link should be considered extremely suspicious.

3. What happens if I click the link in the Sunpass scam text?

The link will take you to a fake website pretending to be Sunpass and asking for personal info and credit card details to pay the “outstanding tolls.” If entered, the scammers can steal your identity, make fraudulent charges, and siphon money from your bank account.

4. What specific personal details are requested?

The fake Sunpass websites request information like your full name, phone number, license plate number, home address, driver’s license details, and credit card number and security code. Some even ask for scanned copies of personal documents.

5. How do the scammers get your phone number?

Most smishing scams start with huge batches of texts sent to random phone numbers to cast a wide net for victims. Regional area codes are often used. Yours may have been randomly generated or purchased on the dark web by scammers.

6. Why do the scam texts mention Sunpass specifically?

Invoking widely used services like Sunpass makes the texts seem instantly more legitimate. Since millions of Florida drivers use Sunpass tolls, more people are likely to think the message could be real at first glance.

7. How can I avoid falling for the Sunpass text scam?

Do not click on any links, provide personal information, or call phone numbers provided in suspicious texts. Even clicking a link can verify your number as active. Instead, delete the text and call Sunpass directly to check for real unpaid tolls.

8. What should I do if I already entered my information?

If you provided your details, immediately contact your bank about fraudulent charges, place a fraud alert on your credit, and monitor your credit reports closely for signs of identity theft. Change any compromised account passwords right away.

9. How can I protect myself from future text scams?

Never click links or call numbers from unknown senders. Confirm unpaid bills directly with companies, not via texts. Download scam call and text blocker apps. And warn family and friends about current scams to prevent them from falling victim.

10. How can I report the Sunpass scam text?

You can report the smishing scam attempt to your mobile carrier, Sunpass directly, and the Federal Trade Commission and Federal Communications Commission to help track down scammers.

The Bottom Line

Scams impersonating Sunpass and claiming you have outstanding tolls are on the rise. If you receive a text stating you owe payment, do not click the link or provide any personal or financial details. These scam messages are sent en masse by smishing fraudsters aiming to steal data through fake Sunpass payment sites.

Follow security best practices like avoiding clicking links in texts from unknown numbers. Be especially wary of messages that demand urgent action or payments. Confirm any payment requests or account issues directly through official channels – not numbers or sites provided in suspicious texts.

With smishing scams proliferating, it’s crucial to be cautious with links and take preventative measures. But through education and vigilance, you can protect yourself and avoid becoming the victim of a Sunpass scam text or the next smishing fraud.

![Remove BrowsingLive.net Redirect [Virus Removal Guide] 10 1 1](https://malwaretips.com/blogs/wp-content/uploads/2023/10/1-1-290x290.jpg)